Help the Crisis Loan application Get back Rate

Objective Review

The fresh new FY13 baseline number to possess Emergency Loan application Go back Rate was 24%, therefore the purpose to have FY14 would be to achieve 31% and you may 34% when you look at the FY15. Increasing the application get back speed commonly increase the delivery of one’s Emergency Loan System. The primary chance becoming addressed is the fact a high software come back price will be bring about more disaster survivors you to will sign up for disaster loan direction and you will located the necessary Federal disaster assistance. SBA’s want to improve the application come back rates and ensures that SBA’s disaster guidance tips having people, non-funds teams, residents, and you will tenants is going to be deployed rapidly, efficiently and effortlessly so you’re able to preserve jobs and help come back small enterprises in order to procedure.

SBA’s propose to help the app get back speed often ultimately create the fresh new Crisis Mortgage Program far better because of the: 1) protecting costs into the emailing software boxes in order to one hundred% of crisis survivors regarded SBA; and you will 2) releasing upwards resources intent on getting ready and you will emailing software packages you to definitely can be utilized various other critical areas of the application evaluation process that privately perception control times.

Steps

SBA usually earnestly to disaster survivors. We shall mention ways making into-line the means to access Digital Loan application (ELA) and you may program pointers offered in order to emergency survivors. Office away from Emergency Assistance usually revision ODA’s marketing to improve social experience with SBA’s disaster software, having emphasis on direct links towards the ELA app. We’ll take advantage of news media to draw demand for this new Disaster Loan Program and offer fast access to emergency survivors. All round method was geared towards all of our internal partners and the brand new external recipients off disaster recommendations.

The applying get back rate is basically impacted by this new impact from personal catastrophes and variance for the particular emergency (flooding, snap, flames, an such like.) and you americash loans Brantley can report products (Presidential-Iindividual Assistance, Company, Financial Burns off Crisis Mortgage (EIDL) only). SBA tend to display screen this new feeling these contextual evidence have on the the general advances of one’s top priority goal to boost the application get back price.

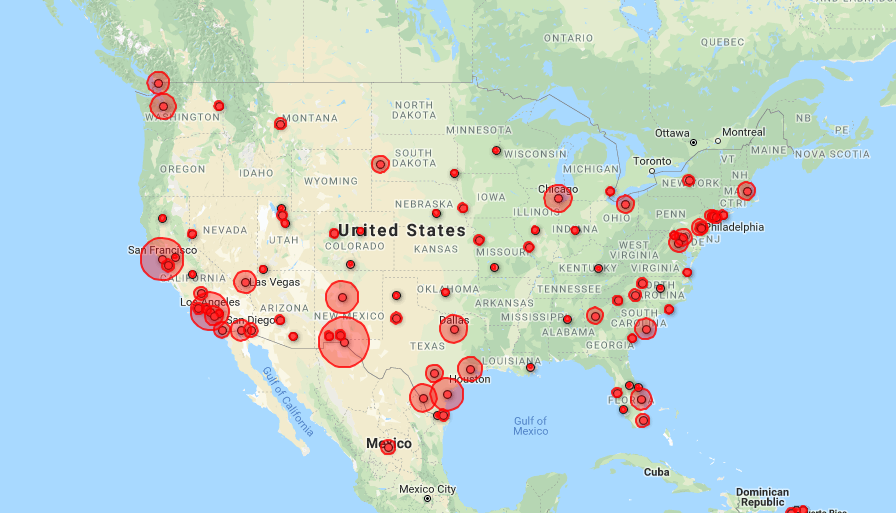

We are going to plus go through the come back rate to find out if there is people influence on purpose end considering venue out-of the latest emergency, size of the new disaster and kind of your disaster.

- Disaster survivors’ reluctance so you can trying to get Government disaster loan advice, maybe due to the following causes: unwilling to make an application for even more loans; express economic recommendations, vow guarantee so you can secure financing otherwise general issues more than unsure healing away from regional cost savings.

- Disaster survivors could be reluctant to submit an application for disaster loan direction in the event the other companies with an increase of trendy terms (e.g. has, forgivable fund, etcetera.) are available to him or her.

Advances Revise

The process improvements regarding prior financial decades (i.age. applying separate app songs to have domestic and you will business loans, use of digital loan requests) permitted the newest SBA to help you efficiently go a premier Application Get back Rates within the FY 2015. And additionally using a different procedure to have giving apps in order to emergency survivors within the Presidential disaster declarations to have Individual Guidelines (IA), SBA reached a tragedy application for the loan go back rates regarding 98%. In advance of FY 2014, SBA mailed an emergency application for the loan to each and every personal and business that inserted that have FEMA and you may regarded SBA having crisis financing guidelines. Today the ideas away from FEMA are contacted by the mobile through Disaster Secretary Customer support Center’s auto-dialer and you may given the choices of applying with the-range, applying in-people otherwise implementing of the post. Men and women not contacted located a page explaining various options to possess implementing.

In every fiscal quarters but you to from FY 2014 as a consequence of FY 2015, the fresh SBA enhanced the latest emergency loan application get back rate, heading regarding twenty four% at the conclusion of FY 2013 to 98% at the conclusion of FY 2015. New SBA increased disaster recommendations by the partnering user-friendly technology and you will streamlining the mortgage application techniques. Instance, the new electronic application for the loan speed increased to 84 percent for the FY 2015, over tripling the rate away from FY 2011. The newest SBA is consistently reviewing and you can applying techniques improvements to enhance program beginning and you can improve the customers feel. Such as for example, this new digital loan application (ELA) to own crisis recommendations financing have basic the loan software process, racing delivery off assistance to eligible emergency survivors and you will improving the integrity of data found in this new underwriting process via the Disaster Borrowing from the bank Administration System (DCMS). And additionally, SBA dependent calculate financing running day criteria centered on tiered membership of software quantities (regarding lower than 50,000 programs so you can over 500,one hundred thousand software) which will surely help SBA better carry out customers traditional in line with the quantity of crisis hobby.