Keep in mind that financing limits are merely one, restrictions

Throughout these highest-pricing counties, new max Virtual assistant mortgage amount passes away at $726,525, although the number can be less due to the fact its according to research by the local housing industry of these version of counties. Broadening new constraints to have portion that have large-than-mediocre home values try very ideal for people who happen to live truth be told there. The majority of people looking to purchase its very first home invest an average out-of 12-fifteen years preserving because of their down-payment. The higher Virtual assistant be certain that limitations within the high priced housing areas allow you to finance so much more house or apartment with zero down-payment. This helps you save numerous years of wishing and offer your even more freedom when shopping for another type of household.

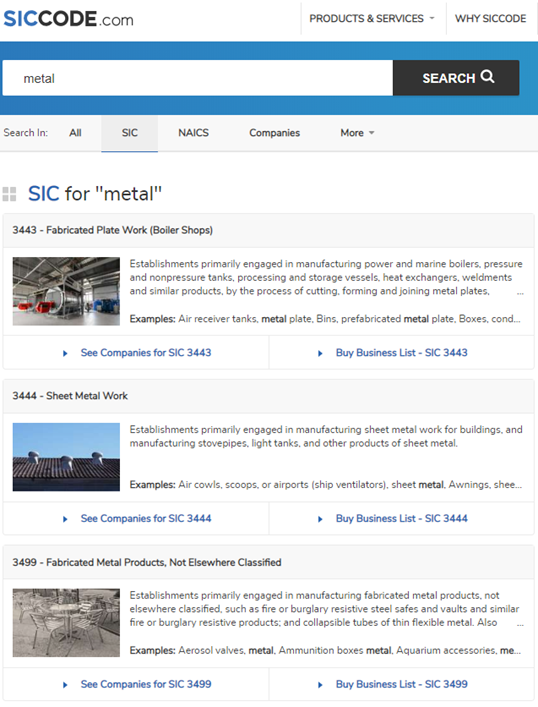

Listed here are a listing of says and territories that have one county where in actuality the loan restriction was a lot more than $484,351:

If you reside in one of the claims in the list above, make sure to browse the where your following house is discover. You will be entitled to take advantage of the higher-prices mortgage restrict. The latest FHFA site provides a great entertaining chart proving which areas feel the highest limits. Click the link.

https://paydayloancolorado.net/rockvale/

They do not make sure you will qualify for home financing of that amount. New Va will not give the money so you’re able to lenders, they just straight back the borrowed funds in your stead. It gives the lending company particular warranty in the event you don’t pay the mortgage later on. If however you reside in a high-prices town, the loan limitation may be the restrict deductible of $726,525. While you are within lowest avoid of your own armed forces pay size, you may not meet the money and you can/or other Virtual assistant criteria of the financial so you’re able to be eligible for that amount.

Just in case you meet up with the minimum provider standards having qualifications, what other standards must you care about? The biggest try your credit score, debt-to-money proportion and you can continual income.

The latest Va has no need for the very least credit history to help you qualify for an effective Virtual assistant loan

Yet not, they actually do nevertheless use it due to the fact a measure of your current borrowing chance. Ideally you prefer a credit rating with a minimum of 620, even though some loan providers will envision you having a get since low once the 580. It is usually smart to check your credit rating just before applying for a beneficial Virtual assistant financial. When your rating is below 580, you need to grab the tips wanted to enhance your rating before applying.

Brand new Va mortgage amount is decided exclusively at the discernment of financial

You’ll also need establish you really have a reliable money that enables getting care of the house. It’s your loans-to-income proportion, or DTI. The brand new Va recommends an effective DTI zero more than 41%. The majority of your biggest costs count on deciding your own DTI. The home loan shall be the largest costs, followed closely by payment funds having cars and you will education. Playing cards, alimony and you will man help costs also are incorporated. The brand new Va desires to score a well-game picture of your financial fitness, thus loan providers may check childcare will cost you and you can electricity expense.

Along with DTI, the brand new Virtual assistant investigates residual income. They would like to make sure you have sufficient money remaining immediately after paying your own monthly obligations to handle regular monthly costs. The remaining earnings is comparable to the debt-to-income ratio, but not an equivalent. To get your own residual income, subtract the expenses used in calculating your own DTI out of your monthly income. The brand new Va bases exactly how much residual income is needed considering the size of your family and you will in which in the nation you alive. The nation was divided towards the four avenues: Northeast, Midwest, Southern area and Western. For example, a family out of cuatro on Midwest has a continual earnings threshold of $1,. That means that immediately following their normal costs are paid back, you really need to have no less than which number left to cover living expenses toward day.