Another option is to obtain a phone number into lender’s site and you can name physically

I discovered that you can buy quite real quotes across the cellular phone. If you prefer a quote which will end up in a strong render, you will need to supply the lender your Societal Protection matter.

Earlier deciding on lenders, decide what type of home you have in mind together with particular away from mortgage need. You will need certainly to give the lender your local area within the the procedure. Are you starting to go shopping for a property, otherwise have you got an accepted give or a signed bargain?

After you begin completing loan applications, you will be likely to guarantee of a lot aspects of debt and you can private lives. Make sure it a portion of the procedure proceeds effortlessly with your essential documentation available. Consider Zillow’s list away from what is constantly called for.

Inquire each lender on a great float off alternative on your own mortgage, states Keith Gumbinger, vice president of HSH, home financing advice site situated in Riverdale, N.J.. Using this type of alternative, their financial speed drops ahead of closure if the rates of interest slip-even if you’ve already locked about rate. Though the feature always need a fee-possibly $500-it can save you huge when the rates refuge. Float-lows are not uncommon, but people have to check out them, Gumbinger says.

Evaluate Quicker Lenders

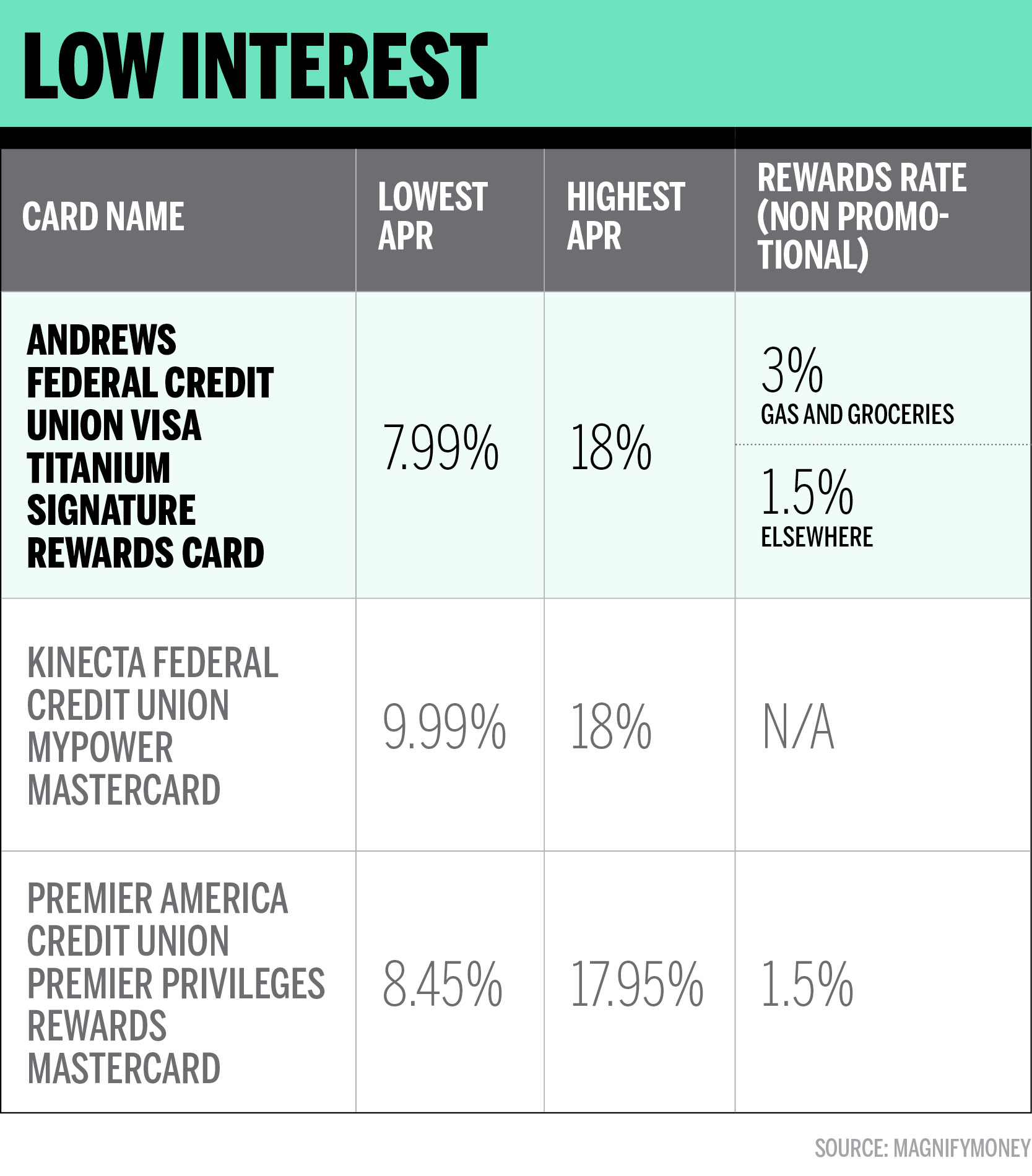

In addition to given a mortgage from the big banks and you may online lenders, search quicker, lower-profile users such as borrowing from the bank unions and you may neighborhood finance companies.

Search online for the term of your house state and you may terms like society financial home loan, S&L financial, and you may borrowing partnership financial.

We found some aggressive alternatives by doing this. Not very from Consumer Reports’ Yonkers, N.Y., head office, Maspeth Federal Coupons for the Maspeth, N.Y., is actually exhibiting an annual percentage rate off cuatro.008 per cent to have a normal 29-12 months fixed loan. Cleveland-created Third Federal Discounts & Mortgage is proving a thirty-season fixed-rate antique loan that have an annual percentage rate off 4.47 percent.

Gumbinger claims these types of reduced lenders typically have top costs to possess variable-rate mortgage loans and provide better words and rates to those with variable income channels, such as the worry about-operating. This is because they frequently try not to offer those individuals fund throughout the supplementary industry once the huge banks carry out, Gumbinger states: Since loan providers is putting such finance on the books, they’re able to speed her or him in whatever way it like to.

Consider a large financial company

A mortgage broker can be shop one of of several loan providers and also finest pricing than you possibly might yourself. However, be aware that brokers receives a commission of the finance companies, perhaps not you, therefore take a www.paydayloanalabama.com/susan-moore look carefully.

For those who go the mortgage representative station, get suggestions regarding family relations or acquaintances who have had an effective knowledge of a certain large financial company in earlier times, McBride claims.

Eg quicker lenders, mortgage brokers are a good idea for those whose income is actually varying. They are experts in points you to definitely fall beyond your traditional, Gumbinger claims.

Understand the CFPB Loan Imagine

After you’ve seen certain glamorous pricing off several lenders, query per for a loan Estimate. That is a fundamental file designed by the new CFPB to help you compare mortgage loans. You are able to make use of it to compare different kinds of finance-state, a thirty-year repaired mortgage and you may an effective ten-year varying-rate mortgage.

To track down a loan Guess, you’ll want to offer documents of the income and you can possessions, among other activities. And you will need certainly to supply your Social Protection count therefore, the financial normally search your credit score.

Score Loan Quotes of as numerous lenders as you’re able. Several questions on your borrowing suggestions does not reduce your borrowing get should they every come inside an effective forty-five-big date several months as they are for the very same product-a mortgage loan, by way of example. They are all of the felt you to inquiry not as much as these situations, the CFPB claims, letting you shop around in place of damaging your credit.